We offer a unique value proposition that sets us apart from competitors, with our comprehensive range of insurance and risk management services, combined with commitment to personalized attention & client satisfaction, for businesses seeking to mitigate risk and protect their assets.

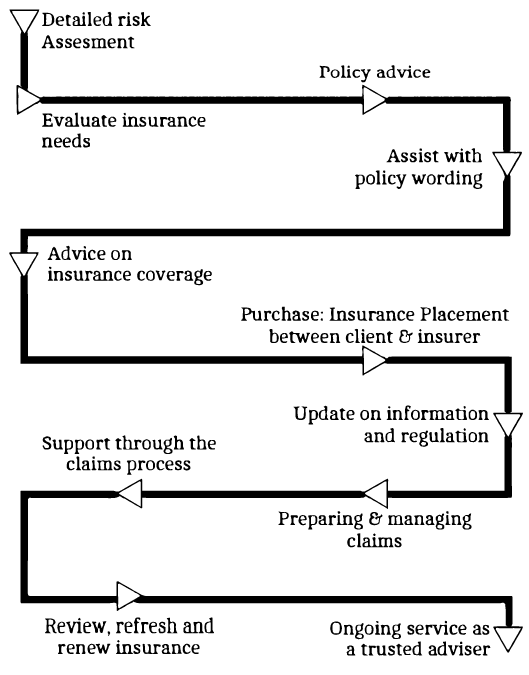

From recommending the best insurance options to ongoing support and policy renewal, we will manage the entire process to save you time and help ensure the best outcome. We will continue to work with you as your personal insurance broking resource and manage your claims from start to end. Our specialist claims team will advocate on your behalf & keep in touch with you every step of the way.

Risk management services are included within our broking services as we believe broking and risk management issues for organisations are indivisible as there is a direct correlation between risk management, claims management and the cost of insuring your risks.

1. Appropriate risk management can assist in preventing incidents, ultimately reducing claims costs. From our experience, risk management practices form an essential education and training tool for all aspects of the business

2. Proactive claims management can identify trends and areas of concern where corrective action can be taken. Fundamentally, you have access to detailed incident and claims reports.

Ultimately, if you can reduce incidents and resulting claims, this will be reflected in the costs incurred in transferring risk, e.g. policy premiums.

Because to ensure a smooth and convenient journey for our clients, we place significant emphasis on standardizing the process of fulfilling their requirements.

Our Key role is to support clients to engage in the insurance market more effectively. Clients can use us to gain information, enabling a greater breadth of access to the market. Clients can receive support to select more appropriate products to match their risk profiles